Back

21 Jun 2023

Gold Futures: Further weakness likely near term

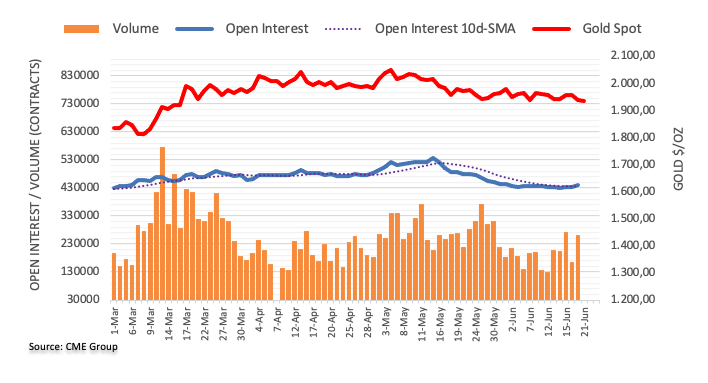

CME Group’s flash data for gold futures markets noted traders increased their open interest positions for the third session in a row on Tuesday, this time by around 7.1K contracts. Volume followed suit and went up by around 97.1K contracts, partially reversing the previous marked pullback.

Gold faces extra consolidation

Tuesday’s daily decline in gold prices was on the back of rising open interest and volume, suggesting that further losses lie ahead in the very near term. The yellow metal, however, is expected to maintain the current consolidation in place since mid-May. Occasional bouts of weakness are still seen supported around $1925 per troy ounce.