EUR/USD - Trend line breached, risk reversals drop and yield spread spikes, eyes Fed minutes

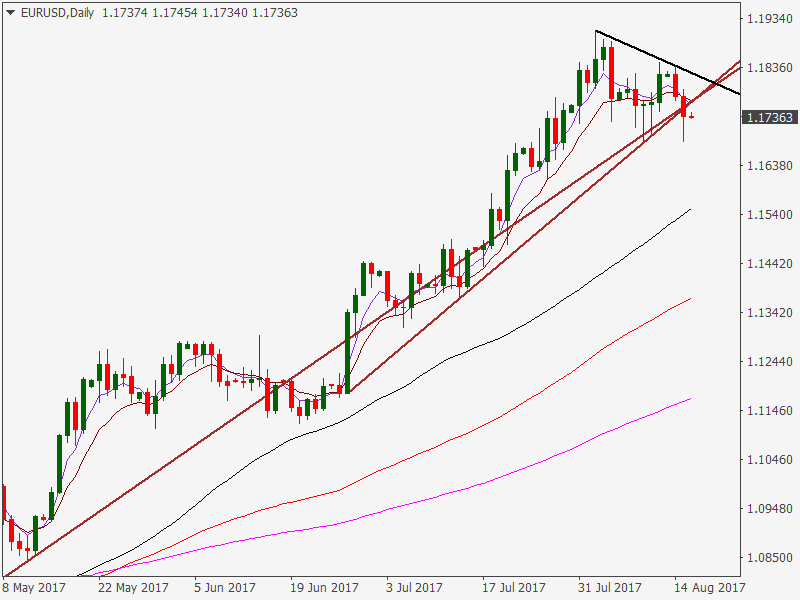

The upbeat US retail sales data finally pushed the EUR/USD spot below the confluence of the rising trend line support seen on the daily chart below. The pair printed a low of 1.1687 yesterday before ending the day at 1.1737.

Daily chart

One-month 25-delta risk reversals drop

The options market is bearish on the EUR/USD. The one-month 25-delta risk reversal fell to -0.237 levels yesterday; the lowest level since May. A negative print indicates increased demand for Put options [downside bets].

US-German 10-yr yield spread breaks higher

- The chart above shows the yield spread continues to widen in favor of the USD following a bullish break witnessed earlier this month.

- Moreover, the bullish break on the yield spread adds credence to the downside break of the crucial trend line support seen on the daily chart.

Focus on Fed minutes

Investors will scan the policy statement for more info on the balance sheet run-off debate. Analysts at Nomura write, “Market consensus has firmed around September for a balance sheet announcement, market uncertainty around the FOMC now rests on the timing of the next rate hike. In that regard, changes in specific language with respect to the number of participants that attribute low prices to transitory factors will deserve some attention”.

EUR/USD Technical levels

The daily chart shows a lower highs formation has been established. The bears now await confirmation of lower lows. The spot remained flat lined in Asia around 1.1735 levels. A break above 1.1769 [10-DMA + rising trend line] would open up upside towards 1.1825 [falling trend line] and 1.1847 [Aug 11 high].

On the downside, breakdown of support at 1.1687 [previous day’s low] would open doors for 1.1618 [weekly 200-MA] and 1.1572 [weekly 10-MA].