Back

17 Jul 2018

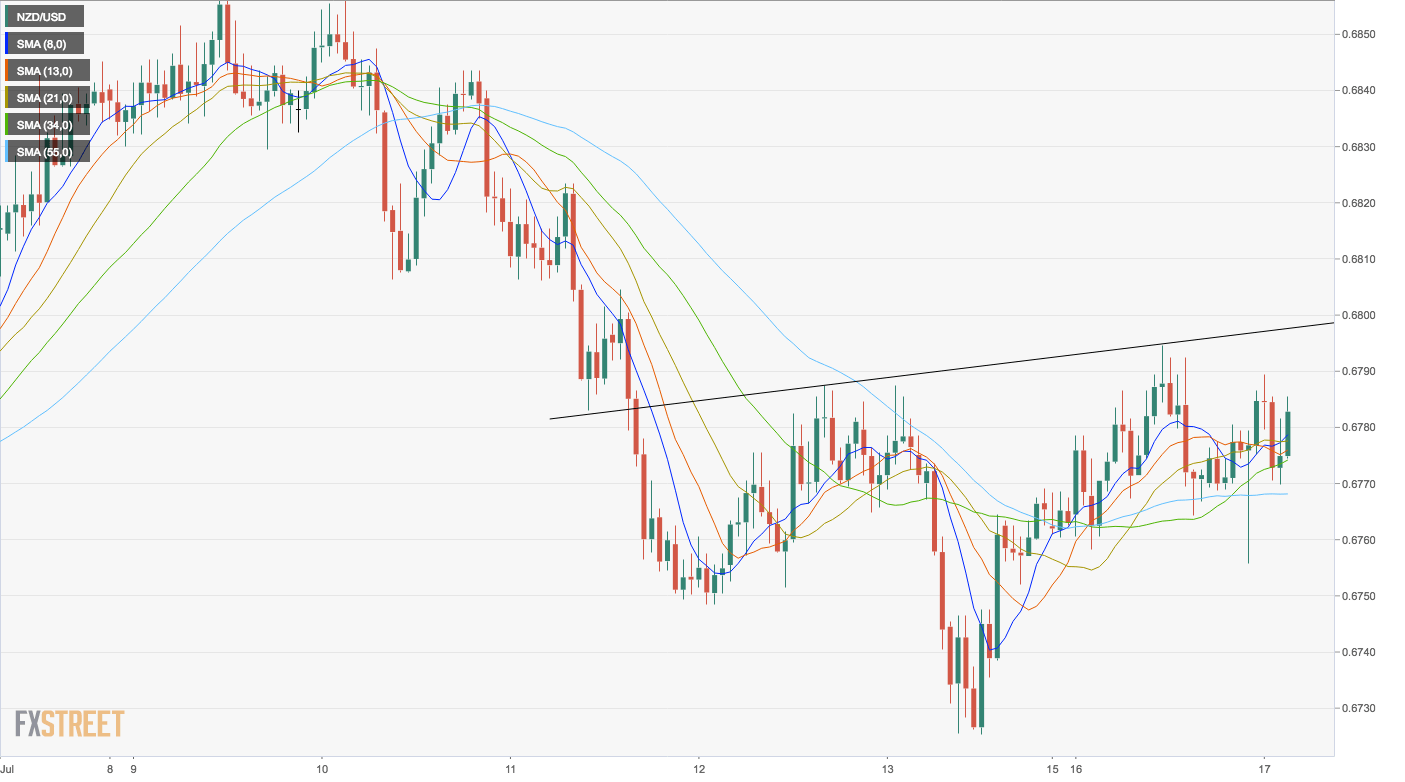

NZD/USD Technical Analysis: Charting an inverse head-and-shoulders

- NZD’s recovery from post-CPI low of 0.6750 could end up creating an inverse head-and-shoulders pattern with neckline resistance of 0.6795.

- A break above the neckline would open doors to 0.6865 (target as per the measured move method).

Hourly chart

Spot Rate: 0.6775

Daily High: 0.6788

Daily Low: 0.6755

Trend: Bullish above 0.6795

Resistance

R1: 0.6795 (inverse head-and-shoulders neckline)

R2: 0.6804 (20-day MA - acted as stiff hurdle on July 9,10, and 11)

R3: 0.6859 (July 9 high)

Support

S1: 0.6748 (July 12 low)

S2: 0.6725 (July 13 low)

S3: 0.6688 (July 3 low)