US Dollar Index climbs to 2020 highs above 98.30

- DXY extends the upside to the 98.30 region.

- Broad-based risk-on mood helps the greenback.

- Usual weekly Claims, Fedspeak next on the docket.

The buying interest around the greenback remains well and sound in the second half of the week and is lifting the US Dollar Index (DXY) to the 98.30/35 band, or new yearly tops.

US Dollar Index now looks to trade, coronavirus

The generalized improved sentiment in the risk complex keeps sustaining the exodus from the safe havens like bonds, the yen and the Swiss franc and sustains further the upbeat momentum in the buck, helping the index to advance further north of the 98.00 mark.

In fact, recent news cited the possibility that scientists could be working on a medical treatment to tackle the Wuhan coronavirus has been lifting the mood among traders.

In addition, developments from the US-China trade front have returned to the fore after China announced it will halve tariffs on US imports from February 14th following the signing of the ‘Phase 1’ deal.

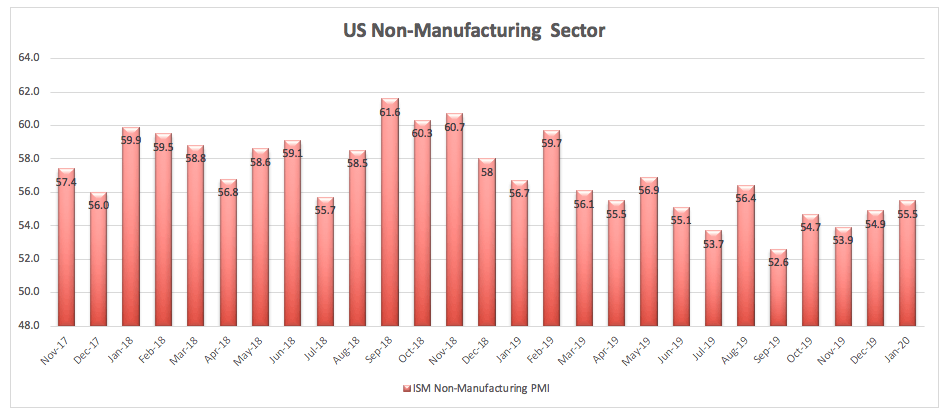

Also collaborating with the rally in the dollar, both the ADP employment report and the ISM Non-Manufacturing (both released on Wednesday) came in above expectations at 291K and 55.5, respectively, for the month of January.

Later in the US docket, Challenger Job Cuts and usual weekly Claims are due along with the speech of Atlanta Fed R.Kaplan (voter, centrist) on the Economic Outlook.

What to look for around USD

The index is prolonging the positive streak and managed to clinch new yearly peaks beyond 98.30, always against the backdrop of persistent risk-on sentiment and positive results from US fundamentals. Following the neutral/dovish message from the FOMC, investors are now focused on key indicators to be released later this week as well as any news on the Wuhan coronavirus. The recent breakout of the 200-day SMA has reasserted the constructive view on the dollar, which is expected to remain underpinned by the current ‘wait-and-see’ stance from the Fed vs. the broad-based dovish view from its G10 peers, auspicious results from the US fundamentals, the dollar’s safe haven appeal and its status of ‘global reserve currency’.

US Dollar Index relevant levels

At the moment, the index is advancing 0.05% at 98.31 and a break above 98.33 (2020 high Feb.6) would aim for 98.54 (monthly high Nov.29 2019) and finally 98.93 (high Aug.1 2019). On the other hand, immediate contention emerges at 97.87 (68.2% Fibo of the 2017-2018 drop) followed by 97.72 (200-day SMA) and then 97.35 (weekly low Jan.31).