COVID-19 Update: US cases at a critical mass spells danger for DXY

- The global number of infections now stands at over 14.3 million - Johns Hopkins University.

- The WHO reported a record single-day increase in global coronavirus cases today, rising by 237,743 in 24 hours

- In the latest worldwide figures, more than 600,000 people have died with the coronavirus and nearly a quarter of them were in the US.

- Focus on EUR/USD with respect to a DXY/MSCI correlation and a unique problem for the US.

The United States leads the world with a total of 3,739,726 cases and 140,294 deaths, according to figures by John's Hopkins University.

US COVID-19 cases rose 2.1%, in-line with the daily average of the past week.

The EU is in its third day of talks to try to agree on a rescue package for virus-hit countries. Millions of people have been told to stay at home amid an outbreak in the Spanish region of Catalonia.

There are two major themes in play this week, which puts the euro vs the US dollar under the spotlight.

Firstly, as the US situation spirals to a critical mass of infections, potentially beyond controlling, investors are really starting to become alarmed by the implications at a time where the benchmarks are potentially peaking.

R is now above the critical level of 1 in all but five of the US’s 50 states

Fulcrum economists have developed a new model. It suggests that the virus’s effective reproduction number, known as R, is now above the critical level of 1 in all but five of the US’s 50 states.

In an article within the Financial times today, it was argued that the US COVID-19 surge could trigger a double-dip recession.

Read more here: US COVID-19 surge could trigger a double-dip recession – FT

In one of the worst-hit areas in the States, it was reported that Texas Gov. Greg Abbott on Sunday announced the US Navy has been deployed to assist in combatting COVID-19 as the state has reported more than 10,000 cases for five consecutive days.

Texas reported 10,158 new COVID-19 cases for a total of 317,730 as of Saturday, fourth-most in the nation.

The state has reported more than 10,000 new cases every day since July 14 when it tallied 10,745 new cases.

Meanwhile, in Florida, which has become the latest epicentre for the virus, it reported 12,478 new positive cases, the fifth day in a row more than 10,000 and 89 deaths over the past 24 hours Sunday.

Florida has the third-most cases in the nation with 345,612 and the eighth-highest death toll at 4,982 and an additional 109 nonresidents.

New York, which still leads the nation in total cases with 406,807 and death toll at 25,048 since the start of the pandemic, reported 502 new cases and 13 new deaths within the past 24 hours Sunday.

As of Saturday, California had reported the third-most cases in the nation with 375,363, including 9,199 new cases. The state also has the fifth-highest death toll at 7,595, with 120 new deaths reported on Saturday.

US Dollar under pressure

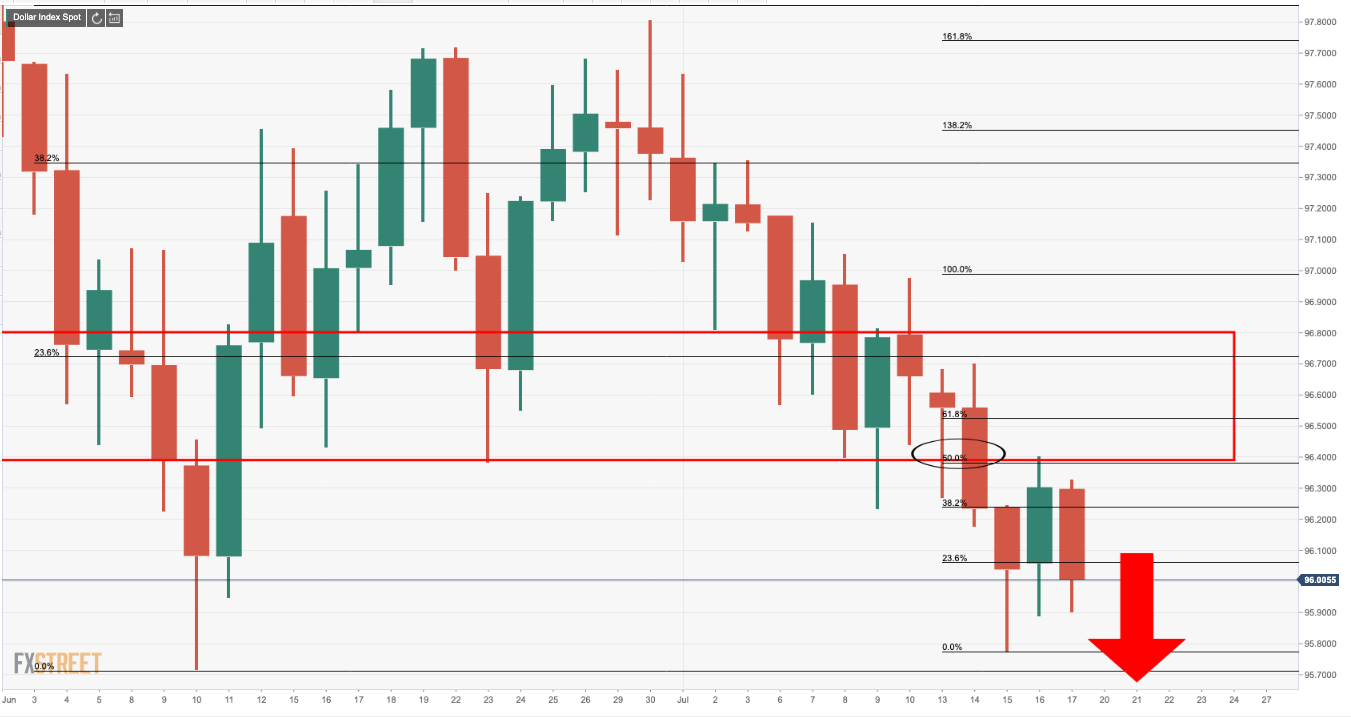

The greenback has buckled as per DXY daily chart:

Technically, it is ripe for a bear continuation having already made it to and been rejected by a 50% mean reversion level of the prior bearish impulse.

Fundamentally, should the coronavirus appear to investors to be a unique problem for the US, we could continue to see a meaningful recovery emerge in the emerging markets.

US markets could also be pressured if US lawmakers fail to extend some of the government programs as businesses and families struggle during the crisis.

A surge in U.S. cases and drop over the fiscal cliff will not bode well for the DXY.

The euro is a likely beneficiary of such a scenario whereby the correlation between the DXY and the MSCI remains compelling. At the time of the peak in the DXY mid-March, the MSCI bottomed and rallied.

If the DXY continues to unwind, and should there be a breakthrough of the deadlock in the EU's coronavirus rescue package soon, we could see the euro take-off.

-

The Chart of the Week: EUR/USD to complete a reverse H&S prior to next leg higher?